See the companies benefiting from our ESOP liquidity solutions, creating wealth for their employees and standing out as top employers.

Empowering growth-stage startups in India with sector-agnostic investments for scalable success.

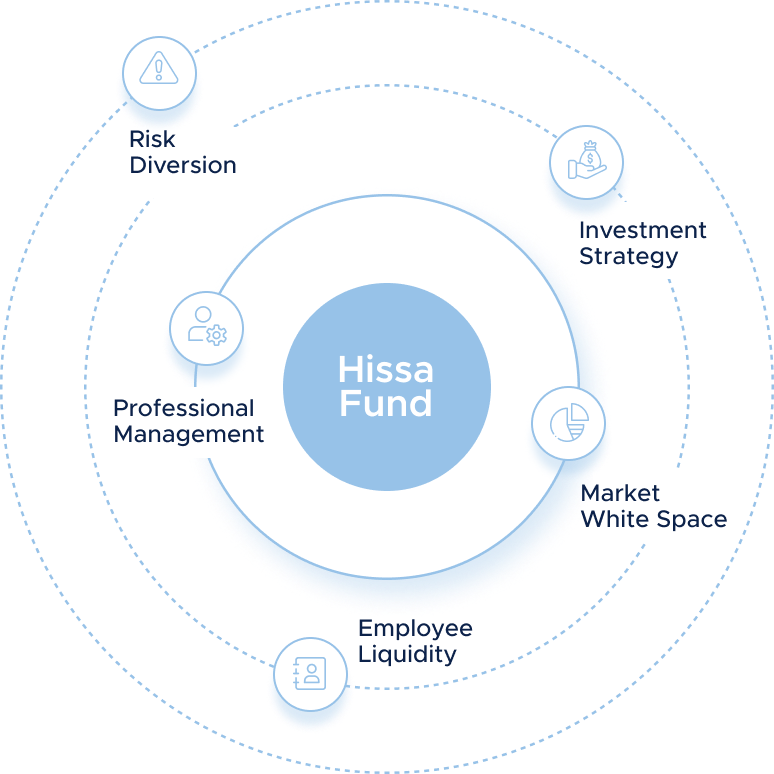

Hissa fund is dedicated to investing in growth-stage startups that are domiciled in India, tapping into the vibrant and rapidly expanding entrepreneurial ecosystem. The fund aims to support scalable ventures that are poised to become leaders in their respective fields. This focus also aligns with our strategy to contribute to and benefit from India's economic dynamism and help build financial infrastructure for the startup ecosystem by enhancing the value of ESOPs.

Our fund adopts a sector-agnostic strategy, focusing on the intrinsic value and potential of businesses across various industries. This broad perspective allows us to capitalize on unique opportunities and innovations without being limited by industry boundaries. By investing in a diverse range of sectors, we aim to achieve balanced growth and minimize risks.

For a growth-stage startup, securing product-market fit marks a pivotal achievement. It indicates that the product successfully meets market demands, leading to increased customer satisfaction and accelerated growth. This alignment drives sales and positions the company for further scaling and investment opportunities.

Elevate ESOP liquidity with tech-driven management and on-demand settlements

Continuous liquidity that helps rationalize compensation cost

Continuous Liquidity vs Liquidity Programmes

Liquidity on demand with a T+ 5 settlement cycle

Tech driven compliance management

Full stack equity management

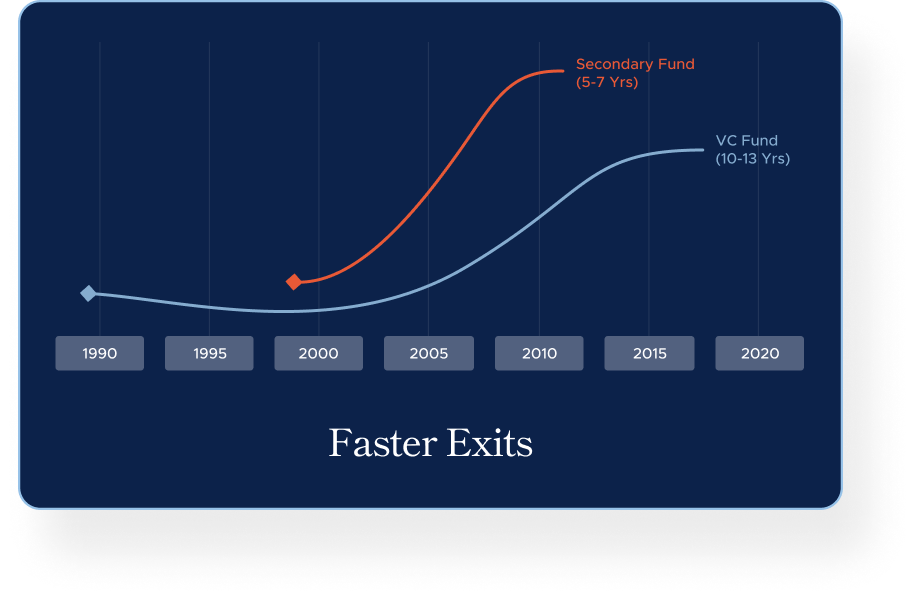

Employees no longer need to wait for traditional liquidity events like IPOs, which take around 13 years, or M&As, which take about 10 years. Instead, they can access ‘liquidity on demand’ through the Hissa fund, allowing them to cash in on their ESOP paper wealth and thereby helping companies to rationalize payroll costs.

Employees no longer need to wait for traditional liquidity events like IPOs, which take around 13 years, or M&As, which take about 10 years. Instead, they can access ‘liquidity on demand’ through the Hissa fund, allowing them to cash in on their ESOP paper wealth and thereby helping companies to rationalize payroll costs

Meet the team committed to delivering efficient ESOP liquidity solutions

Managing Partner

Satish excels in driving product innovation and shaping operational strategy. With a background in deep tech investments, he has analyzed over 1,200 startups, made 12 significant investments, and guided 15 ventures as a former Pre-Series A VC.

Managing Partner

Srinivas spearheads strategy, legal operations, and partnerships, setting new standards for equity financing. As a founding partner at IndusLaw, Srinivas has significantly advanced the firm’s Private Equity, Venture Capital, and TMT practices.

General Partner

Srihari leads Hissa Fund, directing the Investment Management division with expertise and vision. He has raised over $250M and managed $0.5B in assets across real estate and equity. His key responsibility is to build a healthy deal pipeline.

General Partner

Rithvik leads Hissa Fund with focuses in building and maintaining the trust of our valued investors, prudent investment selection and portfolio management. Rithvik has structured and funded over $2 Billion in debt and co-managed a $100 Million debt fund.

Maximize ESOP attractiveness with ‘liquidity on demand,’ allowing employees to convert their ESOPs into cash when needed, while helping companies manage payroll expenses more effectively

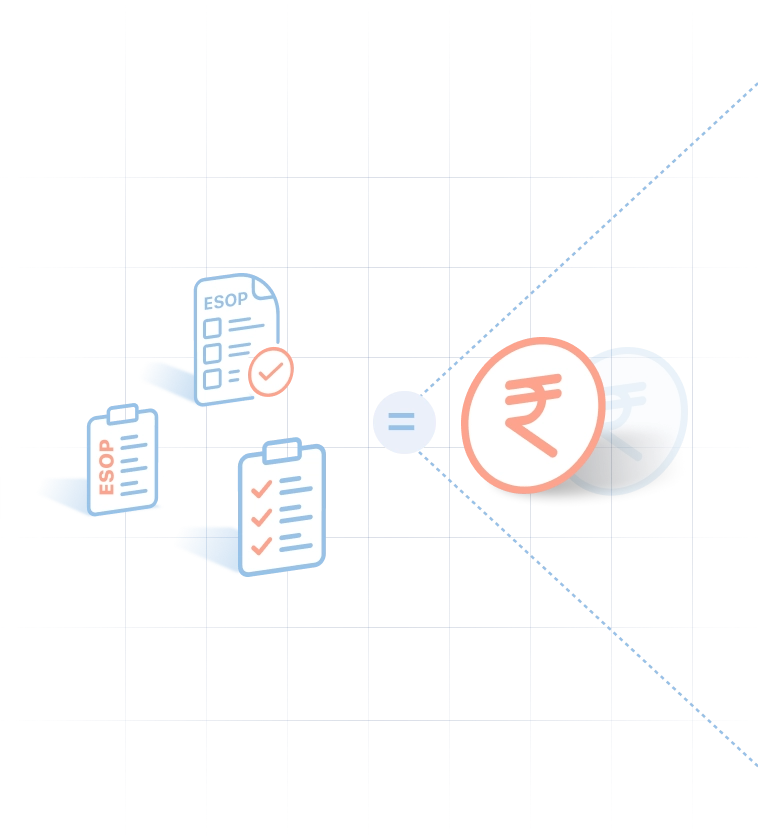

Hissa Fund is an investment vehicle that provides liquidity to employees by purchasing Employee Stock Options (ESOPs), allowing employees to unlock the value of their equity.

Hissa Fund offers employees the chance to convert their ESOPs into cash, providing immediate liquidity without having to wait for an IPO or acquisition. It’s an opportunity to unlock the value of their stock options.

No, selling ESOPs to Hissa Fund does not impact employment status or the relationship with the employer.

Transactions are usually finalized within a T+5 settlement cycle once the transaction documents between the employers and Hissa Fund are mutually agreed upon.

Hissa Fund offers flexibility, letting employees sell some or all of their vested ESOPs. This is usually decided by the employers, and Hissa Fund works closely with them.

Hissa Fund enhances talent retention by offering liquidity options to employees, reducing reliance on cash compensation.

The fund facilitates the liquidity process, allowing employees to sell ESOPs and access cash, boosting morale and easing compensation pressures.

Hissa Fund utilizes its digital equity management platform to streamline liquidity processes, increasing efficiency for all stakeholders involved.

Yes, Hissa Fund offers advisory services to help companies structure ESOP programs and develop strategies for liquidity events, aligning with long-term business goals.

Yes, Hissa Fund can manage multiple liquidity events, providing consistent solutions that help employees liquidate their ESOPs over time, especially in growing companies with different funding stages.

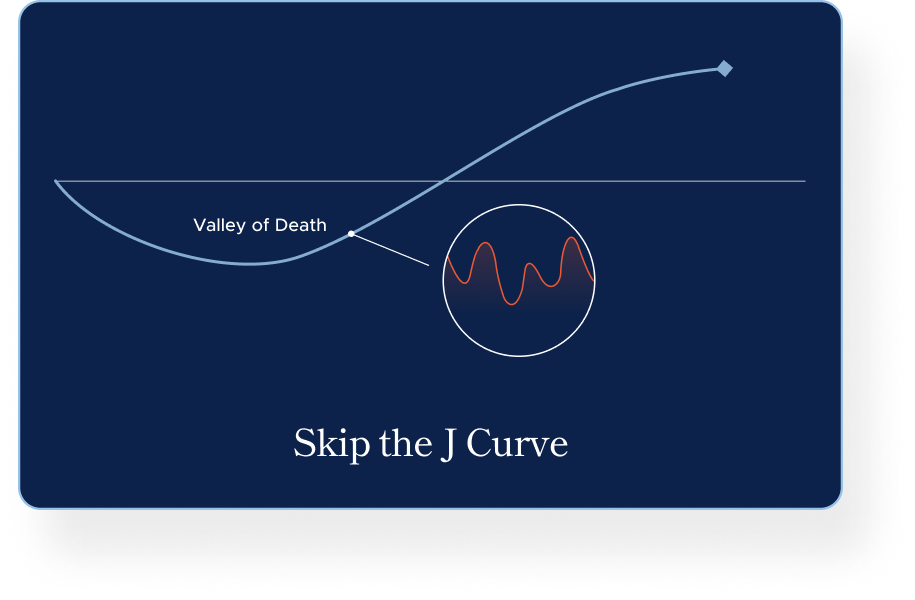

The fund offers unique non-linear returns by investing in exercised stock options from growth-stage startups, bypassing the typical J-curve of venture capital investments.

Hissa Fund invests in ESOPs of Series B+ companies, giving employees an opportunity to liquidate their equity before a major liquidity event like an IPO or acquisition.

Hissa Fund ensures a fast, T+5 settlement cycle, providing efficient liquidity through a digitized equity management platform.

The exit strategy for investors typically revolves around the liquidity events of the underlying startups, such as an IPO or acquisition. Investors can expect to see returns as these events unfold.

Hissa Fund focuses on the intrinsic value and growth potential of businesses across industries, enabling it to seize diverse investment opportunities without sector limitations.

13,000

13,120 (0.12%)Hissa INDEX

New8 Jun 24Convertible Round Calculator

Estimate equity conversion from convertible notes

Anti-Dilution Calculator

Calculate share adjustments to protect from dilution

Liquidity Calculator

Determine optimal exit payout

Pool Size Calculator

Optimize stock option pool size for grants

ESOP Offer Calculator

Evaluate ESOP values in different scenarios

Meet the visionaries behind our journey

Our Mission

Understand our core purpose and vision of reimagining private markets

Team

Discover the people driving the transformation to a digitized equity platform

Our Clients

Explore the companies on our platform

Our Investors

Learn who has fueled our growth and success to date

Founders

Meet the visionaries behind our journey