In the high-stakes world of startups, cap tables are more than just financial documents; they are strategic blueprints of the company’s equity ownership. A well-managed cap table is a crucial tool for making informed decisions about growth, investment, and equity. It tells the story of your startup’s progress and potential.

Maintaining an accurate cap table can be the key to securing funding and avoiding unexpected dilution. Ready to uncover the secret behind this essential tool? Let’s dive into what makes cap tables the backbone of your startup’s financial health.

What is a Cap Table?

A capitalization table, or cap table, is a detailed spreadsheet that outlines the ownership structure of your company. It captures who holds shares, how much capital has been invested, and what types of securities are in play. Think of it as the financial map of your startup’s equity landscape, detailing everything from shareholder names to ownership percentages and the market value of shares. For private companies, cap tables are essential for tracking these elements, ensuring that every stakeholder—whether founders or investors—understands their position in the company’s financial ecosystem.

Cap tables are typically represented on a fully diluted basis, meaning they account for all potential shares and securities as if they had already been converted to equity. This comprehensive approach ensures that the ownership structure is accurately depicted, showing the potential impact of stock options, convertible notes, and other securities on the company’s equity.

Key Elements of a Cap Table

- Round: Details the history of capital influx, including how much investors paid for shares and their shareholding status at each funding stage.

- Shares: Represent ownership and voting rights, giving holders a stake in the company’s future.

- Equity: Provides ownership rights, with equity holders last in line for dividends or capital returns.

- Preference Shares: Offer holders priority for dividends and capital returns, providing a safer investment option.

- Valuation: Affects share prices and ownership stakes, including pre-money (value before investment) and post-money (value after investment) valuations.

- Security: Covers types of financial instruments issued, such as equity, preference shares, warrants, options, and convertible notes, each with different rights and terms.

- Shareholding Percentage: Represents the proportion of ownership each shareholder holds, calculated by dividing the investment amount by the post-money company value.

- Net Worth: Determined by multiplying the post-money value of the company by the shareholder’s percentage of ownership.

- Fully Diluted Basis: Assumes all securities and options are converted to equity, providing a complete picture of ownership distribution.

- Price per Share: Calculated by dividing the total investment amount by the number of shares issued in a funding round.

- Amount Raised: The total funds collected during a specific investment round.

- Dilution: Describes the reduction in shareholding percentage due to new investments, calculated as the investment amount divided by the post-money valuation.

- Lead Investor: The primary investor contributing the largest sum and often taking a significant role in the investment process.

- Shareholders: Lists all shareholders by their roles (founders, angel investors, venture capitalists) and their ownership stakes.

- Stock Option Pool: Reserved shares for future issuance to employees, which is replenished as the company grows.

- ESOP: ESOP pool % allowing employees to purchase shares at a fixed, often discounted price, offering a stake in the company’s success.

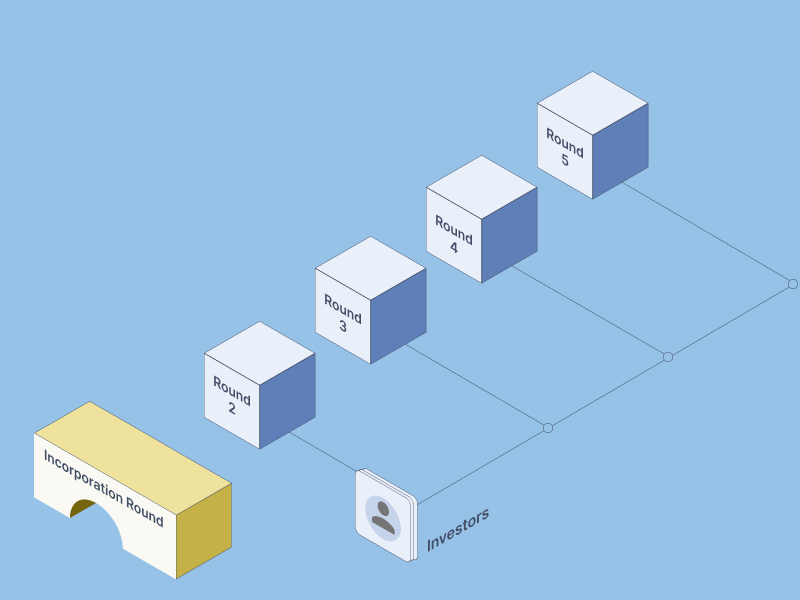

Cap Table Evolution: A Step-by-Step Guide to Tracking Startup Growth

Understanding how a cap table evolves through different funding stages is crucial for grasping how ownership and financial stakes shift as a company grows. Here’s a step-by-step example showing a typical startup’s cap table:

1. Incorporation

At the company’s inception, founders invest their initial capital, establishing their equity stakes:

| Shareholder | Number of Shares | Type of Shares | Investment Amount | Ownership |

|---|---|---|---|---|

| Founder 1 | 5,000 | Equity | 50,000 | 50% |

| Founder 2 | 5,000 | Equity | 50,000 | 50% |

| Total | 10,000 | 100,000 | 100% |

2. Angel Round

As the company grows, it seeks additional funding. Angel investors invest ₹10,00,000 each at a pre-money valuation of ₹1,05,00,000. The cap table adjusts accordingly.

Pre-money Valuation

₹ 1,05,00,000

Investment Amount

₹ 20,00,000 (2 investors x 10,00,000 each)

Post-money Valuation = Pre-money Valuation + Investment Amount

1,05,00,000+20,00,000

₹ 1,25,00,000

Each investor's percentage ownership

= (10,00,000/1,25,00,000)

= 8%

Founders hold 10,000 shares, which is 84% of the total shares, new investors hold 8% each (Total 16%).

Total shares after new investment

= 10,000/0.84

= 11,905 Shares

Each New Investor Shares

= 11,905*8%

= 952 Shares

| Shareholder | Number of Shares | Type of Shares | Investment Amount | Ownership |

|---|---|---|---|---|

| Founder 1 | 5,000 | Equity | 50,000 | 42% |

| Founder 2 | 5,000 | Equity | 50,000 | 42% |

| Angel Investor 1 | 952 | Equity | 10,00,000 | 8% |

| Angel Investor 2 | 952 | Equity | 10,00,000 | 8% |

| Total | 11,904 | 21,00,000 | 100% |

3. Creation of Stock Option Pool

To attract and retain talent, the company sets aside a portion of shares for stock options:

Stock Option Pool

10% of the post-money valuation

Total Shares Before Pool

11,904

Total Shares after Stock Options Pool=Total Shares× Stock Option Percentage

= 11,904/ (1-10%)

= 13,227 Shares

Stock Option Pool Shares = 10% of Total shares

= 10%*13,227

= 1,323 Shares (rounded off)

| Shareholder | Number of Shares | Type of Shares | Investment Amount | Ownership |

|---|---|---|---|---|

| Founder 1 | 5,000 | Equity | 50,000 | 38% |

| Founder 2 | 5,000 | Equity | 50,000 | 38% |

| Angel Investor 1 | 952 | Equity | 10,00,000 | 7% |

| Angel Investor 2 | 952 | Equity | 10,00,000 | 7% |

| Stock Options | 1,323 | - | - | 10% |

| Total | 13,227 | 21,00,000 | 100% |

4. Series A Funding

With increased growth, the company seeks Series A funding from a venture capital firm:

Pre-money Valuation

INR 22,00,00,000

Investment Amount

INR 50,00,000

Post-money Valuation = INR 22,50,00,000

New investor shares = (Investment Amount / Post-money Valuation) x Total Shares

(50,00,000/22,50,000)*13,227

= 301 Shares

| Shareholder | Number of Shares | Type of Shares | Investment Amount | Ownership |

|---|---|---|---|---|

| Founder 1 | 5,000 | Equity | 50,000 | 37% |

| Founder 2 | 5,000 | Equity | 50,000 | 37% |

| Investor 1 | 952 | Equity | 10,00,000 | 7% |

| Investor 2 | 952 | Equity | 10,00,000 | 7% |

| Venture Capital | 301 | Preference | 50,00,000 | 2% |

| Stock Options | 1,323 | - | 10% | |

| Total | 13,528 | 71,00,000 | 100% |

Insights and Ideas for Stakeholders

Cap tables offer more than a snapshot of ownership and share transfers. They provide crucial insights into a company’s financial health and future potential. By analyzing the cap table, stakeholders can engage in thoughtful planning and strategy development, paving the way for sustained financial growth and success.

For a deeper dive into cap tables and their impact on your startup’s journey, explore our detailed guide ‘Decoding Cap Tables’.