The Answer? No!

While ESOPs are a fantastic way for employees to build wealth, but just like that tempting buffet at a party — which might taste great but could also leave you feeling a bit heavy — there’s a price to pay: ESOP TAX

Tax liabilities are an inevitable part of your stock options. However, understanding the nuances of ESOP taxation can help you savor the sweet rewards without getting caught off guard by unexpected costs. As the saying goes, “Better the devil you know than the devil you don’t.”

In this blog, we will act as your paranormal experts, guiding you through the tax implications associated with ESOPs, particularly the perquisite tax. After all, the devil lies in the details.

Before diving into the complexities of ESOP taxation, let’s first understand what stock options are and the journey they entail.

A stock option is a benefit offered by companies that gives employees the right, but not the obligation, to purchase company shares at a predetermined price, known as the exercise or strike price. The idea is simple: if the company’s stock price rises above this strike price, employees can potentially profit by buying low and selling high.

The ESOP Lifecycle: Stages

1. Creation of an Option Pool

A portion of the company’s shares is reserved specifically for employee stock options.

2. Adoption of an ESOP Plan

A formal plan is established, outlining the terms under which stock options are granted.

3. Granting of Options

Eligible employees receive stock options, with specified terms for exercising them.

4. Vesting Schedule

Employees must wait for a set period (vesting schedule) before they can exercise their options.

5. Exercising Options

Employees acquire shares by paying the pre-determined strike price once their options have vested.

6. Liquidity

Employees may sell their shares through company buybacks or to third parties, realizing the value of their stock options.

Recent analytics in ESOPs — where it all begins

- 41% of companies offer ESOPs to all employees, showing a trend toward inclusivity.

- 14% provide them to employees, consultants, and advisors.

- 33% give ESOPs only to senior or core employees, while 12% target specific departments.

In this blog, we focus on the 5th stage of stock options: exercise and the tax implications that come with it, particularly the perquisite tax. This stage is crucial because, while exercising stock options can significantly increase your wealth, it also introduces tax liabilities that many employees tend to overlook.

Knowing how taxes apply at the point of exercise is essential for maximizing your ESOP benefits and avoiding any unexpected financial burdens.

Quickly assess your perquisite tax liability with our handy ESOP Calculator.

Why ESOP Tax Awareness is Essential?

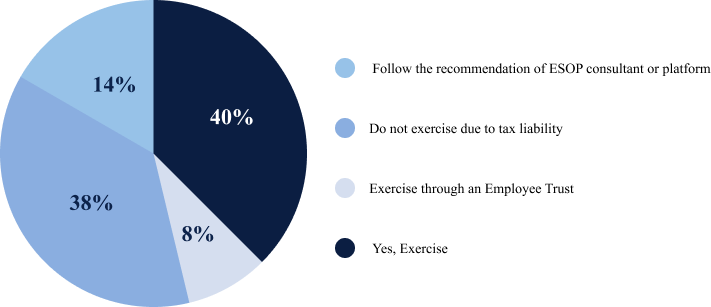

Even though there are real examples of employees getting rich from options, many still hesitate to exercise them. The ESOP Benchmarking Survey conducted by Hissa reveals that 38% of employees refrain from exercising their options due to concerns about tax liabilities.

Stock Options Exercise Survey Results

Unlock exclusive insights into ESOPs — Download the full ESOP Benchmarking report and stay ahead in your ESOP planning.

This raises an important question: Why do employees hesitate to exercise?

1. High Tax Burden at Exercise

When employees exercise their options, the difference between the Fair Market Value (FMV) of the shares and the exercise price is called the Perquisite Value(PV). The tax on PV is treated as Perquisite Tax(PT). This PT can push employees into higher tax brackets, resulting in significant tax bills — up to 42.74% including surcharges and cess.

2. Complex Tax Calculations

Tax calculations for ESOPs can be complicated, and employees need to understand these implications. Without proper guidance, they might struggle to make informed decisions about exercising their options.

3. Market Conditions and Timing

Employees may hesitate to exercise options because the actual tax paid on exercising (PV) might be higher than the actual or realized value of shares.

4. Inadequate Communication and Education

Sometimes, employers don’t provide enough information about ESOP tax rules, which leads to confusion and hesitance among employees about exercising their options.

Understanding Perquisite Value: When the Tax Ball Starts Rolling

Let’s look at an example to illustrate how perquisite tax works for HSF Private Limited’s ESOPs.

- Date of Grant: January 1, 2023

- Date of Exercise: January 1, 2025

- Cost of Acquisition: 5,000

- Granted Options: 100

- Vested Options: 50

- Exercised Options: 50

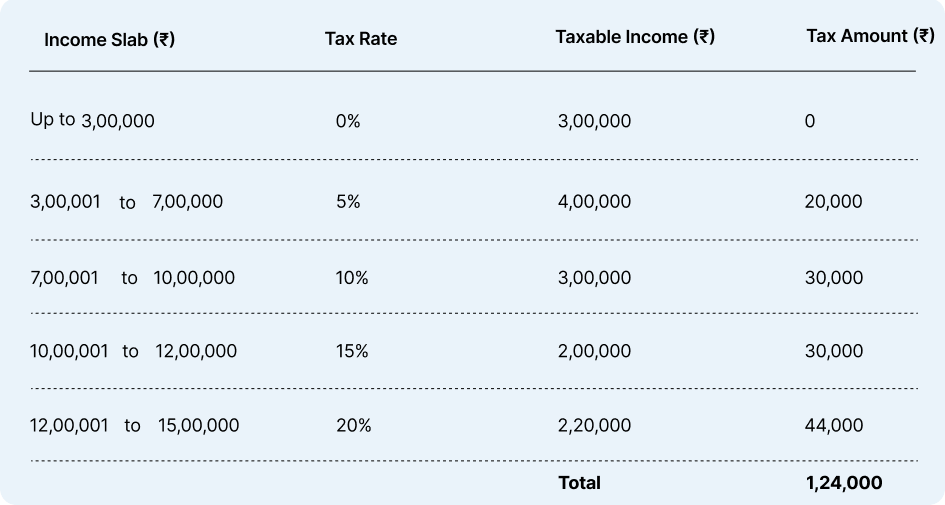

The tax on exercising under both the old and new tax regimes calculates as follows:

Tax on Exercise

This example highlights the significant differences in tax liabilities that arise when exercising ESOP options under the old and new tax regimes. Understanding this is crucial for effective financial planning, empowering employees to make informed choices and steer clear of unexpected tax burdens.

Don’t guess, assess! Find out your ESOP value at the time of the grant — click here!

The Role of Fair Market Value (FMV)

FMV is vital in determining how much tax employees owe on their ESOPs. For private companies, an annual valuation by an independent expert establishes this FMV, which is used to calculate the perquisite value when the options are exercised and the capital gains tax when the shares are sold. Accurate FMV ensures employees aren’t over-taxed on outdated valuations

Emerging Strategies for Mitigating Tax Obligations

1. Deferred Taxation Benefits

Employees of eligible start-up as referred to in Section 80-IAC receive a benefit of deferring the TDS and tax payment on perquisite, for up to four years from the exercise date (or until they leave the company or sell their shares, whichever comes first). This provision helps employees manage their tax liabilities effectively, providing them with the flexibility to strategize their financial planning without immediate tax burdens.

2. Cashless Exercise Options

Many employees are opting for cashless exercise methods to simplify the process of exercising stock options. Cashless exercise allows employees to sell a portion of their shares to cover the exercise price and associated taxes. This approach significantly reduces the financial pressure on employees, enabling them to benefit from their options without needing to pay cash upfront.

3. Financial Assistance Through Loans

Various funds have emerged that offer loans specifically designed to cover the exercise amount and associated taxes. These financial products aim to ease the financial strain on employees looking to capitalize on their stock options. By providing accessible funding options, these loans help employees navigate the costs of exercising their options more comfortably.

4. Educating Employees on ESOP Taxation

As companies work to attract and retain talent, it’s crucial for founders and organizations to regularly update their ESOP policies and educate their employees about them. Many companies are now conducting training sessions to effectively communicate key terms, such as exercise prices and vesting schedules. This approach empowers employees to make informed decisions regarding their stock options.

5. Technology for Better Management

Technology platforms are becoming increasingly essential in providing innovative products to aid compliance and streamline ESOP administration. These platforms can offer employees dashboards to track their options and understand the ESOP worth.

In conclusion, ESOPs are no longer just a bait to attract and retain employees; they have become important benefits that need careful attention. As they grow, staying informed about ESOP taxation and strategies is essential for maximizing their value.

Annexures

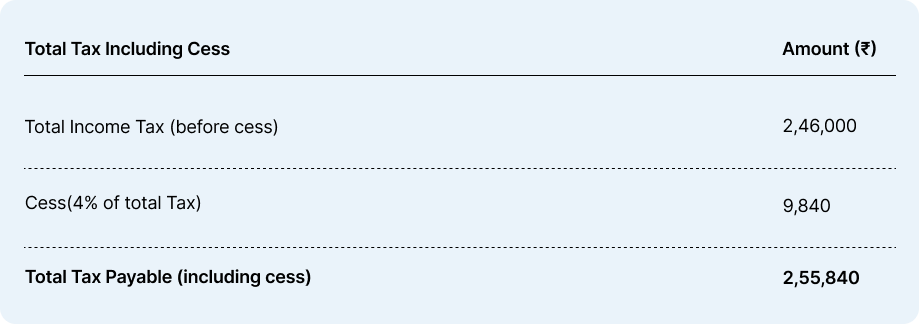

Tax Slabs as per new Regime

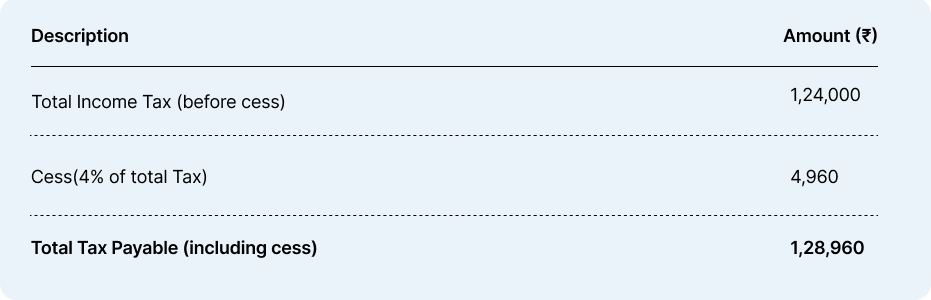

Total Tax Payable as per New Regime

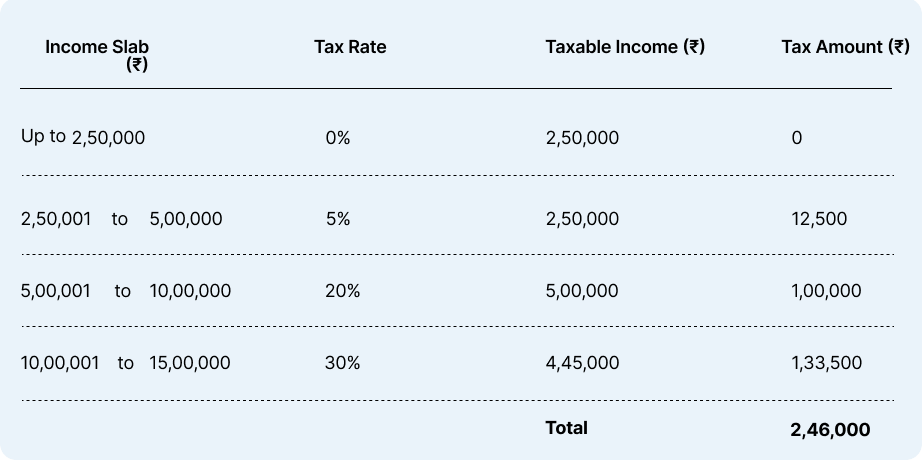

Tax Slabs as per Old Regime

Total Tax Payable as per Old Regime