Understanding ESOPs: How They Work and What Employees Need to Know | Hissa

Employee Stock Option Plans (ESOPs) offers employees the potential for significant financial rewards by aligning their interests with the company’s success. However, the process is not as straightforward as it may seem. An ESOP announcement represents the start of a journey involving vesting periods, exercising options, and managing financial implications. This guide delves into the […]

Founders’ Agreement: Why You Really Need One and What to Include | Hissa

Picture this: You and a co-founder launch an ambitious SAAS startup. You’re the tech expert with a clear vision, while your co-founder is more interested in the title of entrepreneur. Both of you invest equally and share 50% ownership, but you never formalize your partnership in writing. Months later, your co-founder loses interest and decides […]

Spreadsheets to Digital Equity Platforms: Why They’re a Game Changer | Hissa

Equity management is a cornerstone of any company’s financial health and strategic planning. It encompasses everything from tracking ownership stakes and managing shareholder rights to ensuring compliance with regulatory requirements and optimizing financial structures. Traditionally, this has been done using spreadsheets, a method that can quickly become cumbersome and error-prone as a company grows. Enter […]

Anti-Dilution: Ensuring Fair Equity in Down Rounds | Hissa

When investors commit to funding a startup, they do so with the anticipation of seeing their investment grow as the company succeeds. But what happens when a startup’s value drops? How can investors protect their stakes from potential losses in such a scenario? Enter the anti-dilution clause—a crucial component of term sheets that helps safeguard […]

Understanding Company Valuation: Key Factors and Methods | Hissa

The valuation of a company represents its estimated worth and plays a crucial role in guiding strategic decisions for founders, investors, and stakeholders. Valuation provides a snapshot of how much value the company has generated and helps in assessing its future potential. By understanding these elements, stakeholders can make informed decisions that drive growth and […]

Shareholders’ Agreement: Key Terms that Protect Stakeholder Rights | Hissa

A shareholders’ agreement is a crucial legal document designed to define the rights and responsibilities of all parties of an investment deal. It establishes clear guidelines for decision-making processes, ensuring that all shareholders understand their roles and obligations. This agreement helps prevent conflicts by outlining procedures for resolving disputes. It also clarifies ownership stakes and […]

Mastering Cap Tables: Tracking Ownership and Growth in Your Startup | Hissa

In the high-stakes world of startups, cap tables are more than just financial documents; they are strategic blueprints of the company’s equity ownership. A well-managed cap table is a crucial tool for making informed decisions about growth, investment, and equity. It tells the story of your startup’s progress and potential. Maintaining an accurate cap table […]

Simplifying Fundraising: Key Documentation for a Smooth Investment | Hissa

Fundraising, often viewed as a complex maze, can indeed be a prolonged and intricate process. Despite its challenges, it’s an indispensable journey that companies must embark upon to secure capital. This capital infusion is crucial for fueling growth, innovating products, and scaling operations. While there are multiple avenues to raise funds, issuing securities remains a […]

What Is a Term Sheet? A Dive into Its Importance and Key Clauses | Hissa

In the high-stakes world of startups and venture capital, the term sheet is more than just a formal document—it’s the first step toward a significant partnership between a company and its investors. Much like setting the terms of a partnership or business deal, a term sheet outlines the crucial elements of the investment and sets […]

Decoding Startup Financing: Equity, Debt, or Hybrid Securities | Hissa

Choosing the right financing method can make or break a young company. In the fast-evolving landscape of Indian startups, the buzz around funding rounds, private equity, and venture capital has become routine, but behind the headlines lies a fundamental question every entrepreneur must grapple with: How do I raise capital for my startup? Every decision—whether […]

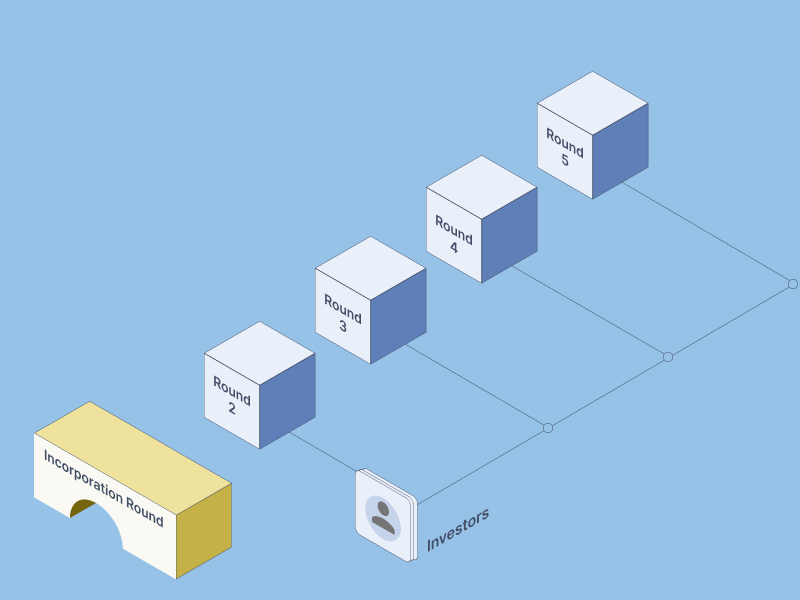

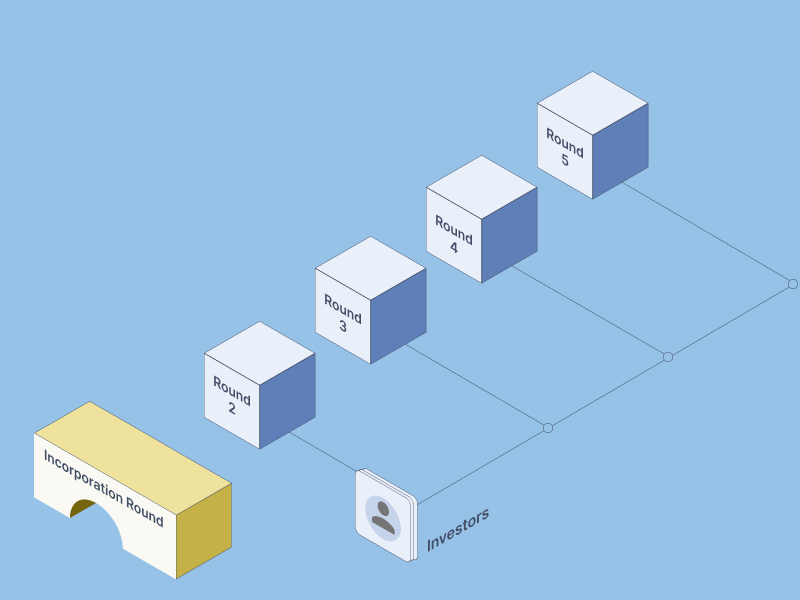

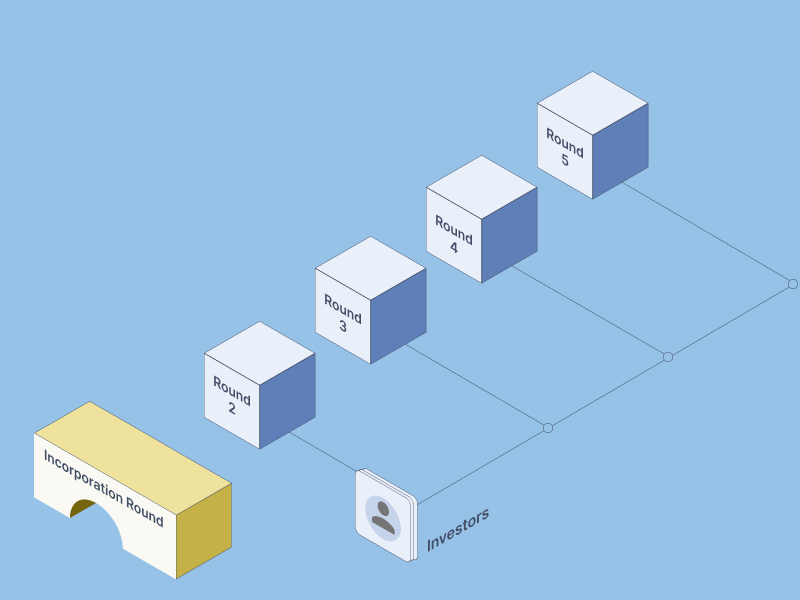

The Startup Fundraising Roadmap: A Complete Guide | Hissa

In the dynamic startup world, launching a company is just the beginning. The true challenge—and opportunity—lies in securing the funds that will propel your vision and drive growth. Fundraising is a high-stakes game where strategy, preparation, and execution converge. Each phase is crucial in shaping your startup’s future and convincing investors that your idea is […]

Convertible Notes: The Smart Path to Early-Stage Financing | Hissa

In the dynamic landscape of startup financing, convertible notes have emerged as a favored instrument for raising funds swiftly without the immediate complexities of company valuation. This flexible financial tool is especially popular during early-stage and seed funding rounds, providing startups with crucial capital while deferring intricate valuation discussions. What is a Convertible Note? Convertible […]